Shares of Bank of America (NYSE:BAC) have outperformed the broader market over the past one-, three-, and five-year stretches, but so far this year the nation's second biggest bank by assets has come up short of the S&P 500.

Should investors be worried about this recent turn of events, or is it much ado about nothing? I think it's the latter.

The simple reason Bank of America's shares have underperformed large-cap stocks this year has to do with the bank's performance last year -- or, more specifically, since the presidential election last November.

The unexpected outcome of the election sent bank stocks soaring. Investors were betting that the new administration's promise to reduce taxes and regulation would bolster profits in the financial-services industry.

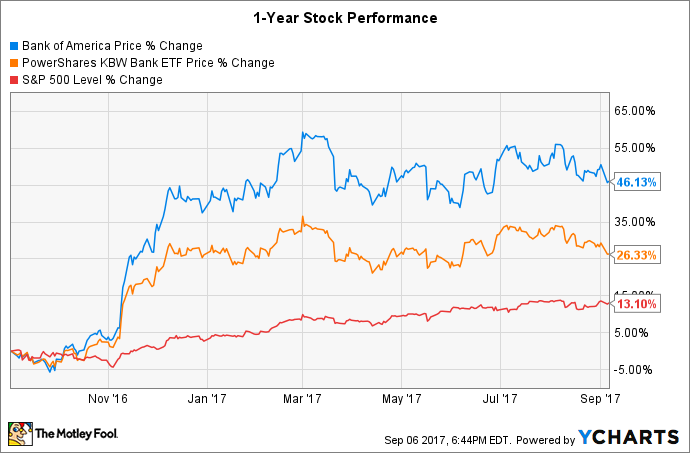

Over the past year, for instance, shares of Bank of America are up 46%. That's almost twice the return on the KBW Bank Index, and it's more than three times the return of the S&P 500.

The rally stalled this year, however, as reality set in regarding how long some of these policy reforms might take to push through, as well as questions about whether some of them will survive the legislative process at all.

The stalling of this rally is therefore what best seems to explain Bank of America's relative underperformance this year, as everything eventually tends to revert to the mean, be it human heights or stock growth rates.

Indeed, despite Bank of America's lackluster performance relative to the broader market this year, the bank itself is actually doing quite well.

- Its net income in the first six months of the year grew 23% compared with the first half of last year.

- Its efficiency ratio, which measure the percent of revenue spent on operating expenses, fell to 59.5% in the second quarter, dipping below the bank's 60% performance target.

- It passed the stress tests and got regulator approval to increase its dividend and share-repurchase authorization.

- Its return on assets, a measure of profitability, climbed to 0.91% in the first half of the year. That's still below the bank's 1% goal, but it's meaningfully better than its 0.76% return on assets in the year-ago period.

IMAGE SOURCE: BANK OF AMERICA.

Moreover, things are improving on the macroeconomic front for banks. The Federal Reserve has increased interest rates twice this year, which boosts Bank of America's net interest income. On top of that, regulators have begun to roll back some of the compliance burden added since the Dodd-Frank Act of 2010.

In short, even though Bank of America's shares have underperformed the broader market thus far this year, the fundamentals at the Charlotte, N.C.-based bank continue to head in the right direction.

Newly released! 10 stocks we like better than Bank of America

On September 1, investing geniuses David and Tom Gardner revealed what they believe are the ten best stocks for investors to buy right now… and Bank of America wasn't one of them! That's right -- they think these 10 stocks are even better buys.

And when the Gardner brothers have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*